Money is the only problem a founder has. You're either trying to figure out where to best spend it or how to get it from customers. And if the gap between spending and receiving is too big, you're trying to get investors to pick up the difference.

In this article, I'm going to focus on strategies for investment for early stage companies. And since I'm writing this in 2025 where investor money is less free flowing than it was a decade ago; the equation has changed. We live in unprecedented times indeed.

Where are you?

Let's start with you, the founder, and where you are on your journey and what money buys you

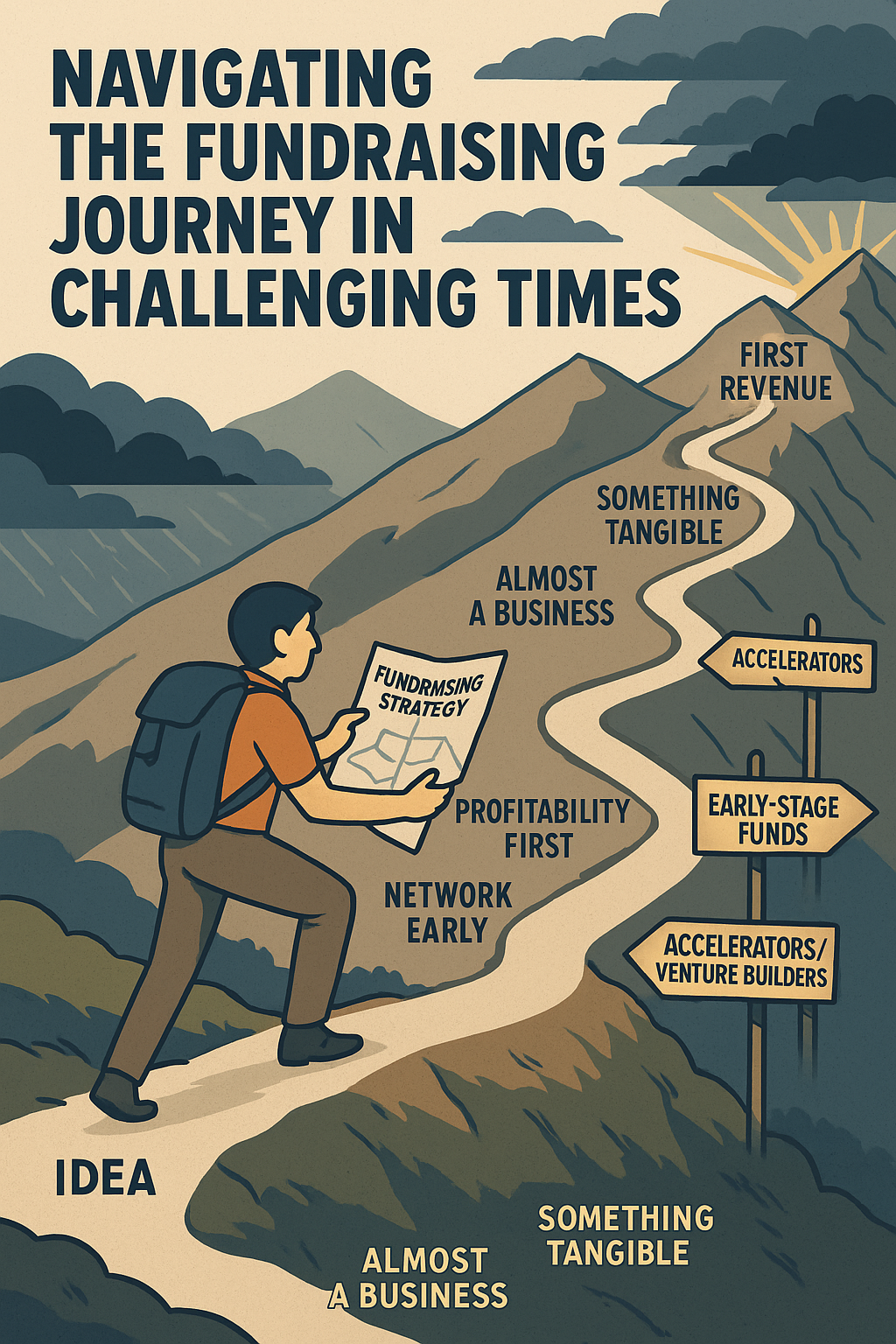

- Idea stage

you have an idea, a hunch, perhaps some experience in the industry. Maybe you've written a business plan and did some napkin financials. But beyond the initial vision and idea, you have not put the wheels in motion.

Any extra money is to start building. - Something Tangible

I'm leaving this broad by design. At this stage you perhaps made a prototype, or you have real potential customers who gave you in-depth feedback, maybe they even showed interest in buying your product later. It's really the difference between an idea, and starting to validate it's a good idea worth executing.

Money here is for proving your business is possible. - Almost a business

You are close to selling something. The idea has evolved into something usable enough for others to try, at least in beta. You also have a go-to-market approach and some idea of the cost of running the operation.

Your funds now are for the finishing touches. - First revenue

At least one customer paid you, and you delivered. Your problem set now shifts to finding more of these.

Obviously this is by far not the end of the journey, but it is where I draw the line for "early stage". Note how they're all mainly concerned with deciding where to spend money, and very little with receiving...

Of risk and reward

Let's turn to how investment evaluates startup risks. Understanding your investors mindset will help you see who's more aligned with you.

First, and most obvious, is use your own savings or start as a side-hustle.

It leaves you in total control, and you can go as fast or slow as you can afford to.

Perhaps you will be a little slower, perhaps you'll have to make things do on budgets you never thought possible, perhaps you may even decide to not do something at all.

From experience, this does focus the mind on running a sustainable business. In today's day and age, that's a good thing.

And while self-funding means you own 100% of the risk, you also own 100% of the upside.

I'm going to lump friends, family and angel investment together as the next layer. The key is they are individuals investing their own money, often through tax incentives like EIS and SEIS. Some of the reward for these investors is already baked in through those tax breaks. The rest is gravy so to speak.

In terms of risk, they know this is a high risk £5k-25k investment on a very long horizon. So you may need 4 or 5 of these to put together a round of funding. None of them will end up representing a huge stake in your business but you can't ignore them as shareholders. Even if they can't impact much on how you run the business.

The next step is early stage funds, professional investors. They put other people's money to work and get a slice of the profits as payment.

The structure of these funds means they often have a 5 - 7 year window to see a return on their £200k-£500k investment.

Statistically, even in the best funds at least 25% of these investments will be worthless. And 50%-ish won't really be meaningful but just return the initial capital. So it's down to the top performers to deliver at least 5x or more to make the fund profitable as a whole.

That's the bar you, the founder, are judged against. Are you capable of delivering that kind of outsized growth in value over the next 5-7 years?

The last group is venture builders and accelerators. While they also invest other people's money, they do come with extra perks.

They will co-build with you, or at least provide you with a lot of coaching and help in getting your idea off the ground. It's a great way to shorten your time to product-market fit, and get experts in the field to help you build your business.

And they're usually quite well connected for guiding you into the next stage of growth. That does however cost a 5%-15% stake in your company in exchange for all that assistance.

Like Venture Capital, they'll take a similar approach to timeline and expectations of you as a founder. The main difference is that they be actively involved to help you on your way.

Navigating this market

So, where do you go from here?

First, realize that the focus of every investor has moved to some degree. We're out of the "growth fixes everything" thinking, and more concerned with good basic economics of sustainable operations.

As a founder, from day 1, start focusing on setting up a profitable operation. Don't assume growth or infinite capital available. Think "minimum viable everywhere", or "high capital efficiency" if you want finance jargon.

Second, focus on the process. Every early stage investor knows that the one thing your business won't be is what is in your pitchdeck.

Ensure you have the right way of measuring and absorbing market feedback. Be clear about your assumptions, and why you pivot along the way.

And lastly, think about the kind of business you want. If you're after a lifestyle business that pays you a steady dividend, maybe outside capital isn't for you? Not every business needs to be a unicorn after all.

If you do decide to raise capital. Start with networking long before you need it. The worst time to raise money is when you're running out and desperately need cash. Be prepared to raise for 18 to 24 months of runway, despite what people tell you. Cash in the bank, and the optionality from that is the most important thing right now.